A Lot of Fast Moving Parts. A Lot of Studying to do.

Simple story. We love the business concept. Basically we have a niche digital marketing and advertising company, in the multi-billion dollar alcohol business.

Smirnoff alone for example spent $100 million on advertising. Maybe (for now) they can’t attract the likes of a Smirnoff, but there are literally 1000’s of news alcohol brands launched each year, that need a good digital marketer. This could provide years of growth, if they are good at marketing. Or at least good at selling their marketing services, to the start-up brands.

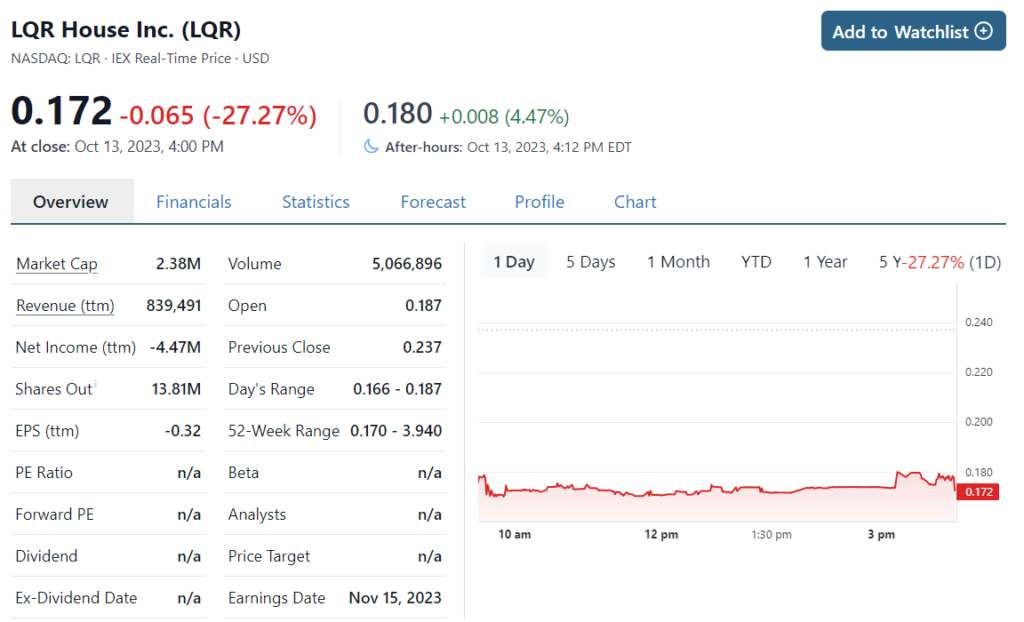

It’s too small, illiquid and volatile for a trade. But it’s down near 95% from it’s IPO in August, so we’re studying it to determine if this could be a $2 or $3.00 stock two or three years from now? The elusive ten-bagger.

We first came across the idea from a hedge fund we know last week, when it was trading at $0.25 and had an incredibly small market market cap near $2.5 million (down from over $50 million at $5.00). So this isn’t for institutions.

They went public at $5.00. Here’s the long-term chart.

LQR House Inc. Announces Closing of $5,750,000 Initial Public Offering

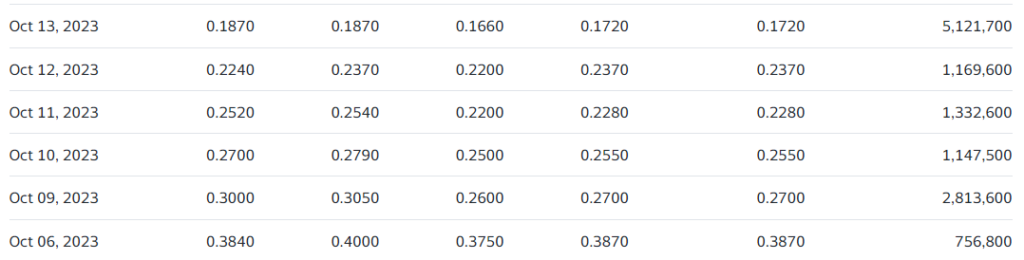

A lot of stocks are performing poorly post-IPO (certainly post secondaries) but this was a eye-opening doozey, so we were interested at $0.25. Then, before we had a chance to read the three-month old prospectus, they raise another $5 million via EF Hutton. This time by selling 28,421,053 shares at $0.19. Wait, what!

LQR House Inc. Announces Pricing of $5.4 Million Public Offering

So we just had to add it to the Watch List at this price!

Assuming it’s a good idea, the strategy here would be to attempt to acquire a meaningful stake, while all the video game type investors are blowing up the volume. These are the guys (and women) who buy at $0.20 to sell at $.0.23 to make a few thousand dollars. Nothing wrong with that, just not our game.

TIME AND SALES

Here’s the offering: Prospectus.

Website: LQR House

One caveat, the balance sheet in the prospectus showed $100,000 in cash. Kinda strange they didn’t have a current balance table displayed, like the day BEFORE the closing.

Anyway, we don’t know if they still have the $5 million from August or if they somehow blew it all. If they still have the $5 million AND they just got another $5 million, then we are highly optimistic about their future.

They had 13 million shares outstanding and then added 29 million so there would 42 million shares outstanding or a market cap of $7 million at $0.17. Hmm.

For updates on LQR:

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Shareholders can identify these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations that arise after the date hereof, except as may be required by law. These statements are subject to uncertainties and risks including, but not limited to, the uncertainties related to market conditions and the completion of the initial public offering on the anticipated terms or at all, and other factors discussed in the “Risk Factors” section of the registration statement on Form S-1 filed with the SEC. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s registration statement on Form S-1 and other filings with the SEC. Additional factors are discussed in the Company’s filings with the SEC, which are available for review at www.sec.gov. Not a client – yet.

Investor and Media Contact:

[email protected]