It’s been little more than a decade since we first added Celcius (CELH) to the Beverage Watch List at $0.99 a share..

LIVE QUOTE

$0.33 to $96 Peak Chart

..or $0.33 per share after a 3:1 stock split in November of 2023. Which gave investors 3 shares, for every one share they held. Pre-split, the shares traded from $0.99 to $288 a share, or a 290-fold gain (aka a 28,000 percent). As in who needs AI stocks..

The shares peaked less than a year ago in May of 2024. $10,000 invested when we added it to the Watch List in 2015 quite magically, grew to $2.9 million, at its peak. Not bad. All a shareholder had to do was be patient (nearly impossible for today’s short term traders lol) and drink a lot of Celcius. Have Celcius for breakfast, for lunch and maybe for happy hour, mixed with Mutiny Vodka, our favorita Vodka! We’ve done our due diligence and various Celcius brands makes for a great mixer.

Celcius Playa Vibe Pino Colada edition – pairs well with any clear rum for that caribbean style beach buzz.

Post-split, the share price gain was from $0.33 to $91.00. Again, not bad.

Initiating Coverage on the Alkaline Water Company.

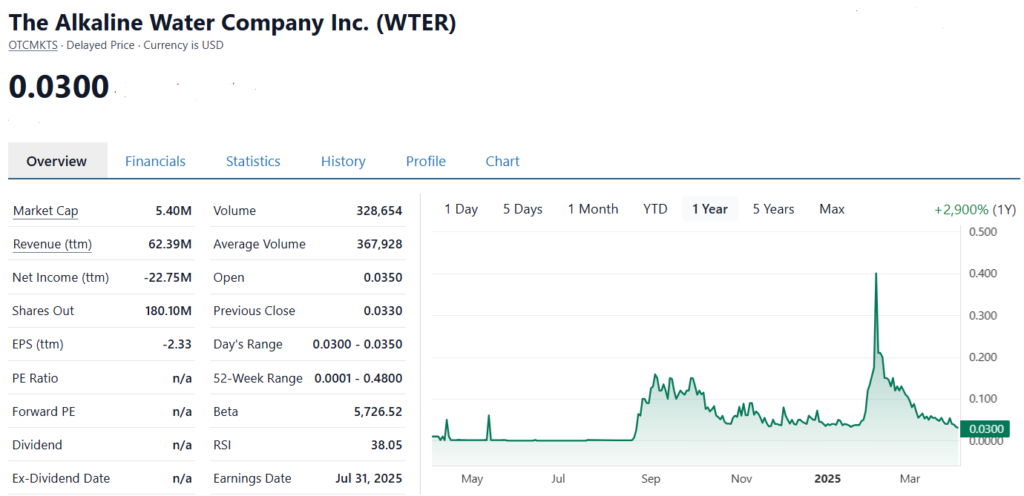

Initiating coverage (also again) on the Alkaline Water Co. (WTER) $0.03 — in what could be the ‘come-back’ of the decade. We originally added WTER to 2015 Watch List at a pre-split price of $0.07. It traded as high as $3.80 before spinning out of control. And…back under control, of the founder Ricky Wright, who took the company from $3 million in sales to near $60 million.

Related News: Former CEO Ricky Wright Returns to Lead The Alkaline Water Company

Alkaline Meteoric Revenue Rise, Before the Fall, Peak Trailing 12 Months Revenues hit $63 Million in 2023

Market capitalization, also called net worth, is the total value of all of a company’s outstanding shares. It is calculated by multiplying the stock price by the number of shares outstanding.

Click Here for Initiation Report.

Celcius Meteoric Rise Bfore the Fall. Madonna Mia. What a Ride

February 18th, 2015 – $0.99. Top Beverage Stocks for 2015.

August 31st, 2018 – $4.18. Faces Sell Cases. Vanessa Walker, VP Marketing @ Celsius (CELH) $4.18.

March 25th, 2019 – $4.90. Adding Celcius to 2019 Beverage Watch List.

August 31st, 2019 – $4.18. Adding Celcius to Focus List.

June 30th, 2020, – $11.00. Celsius Holdings Stock Up 200% In 3 Months But The Party Isn’t Over Yet.

August 27th, 2020 – $21.50. $21.50. Alkaline Water (WTER) vs. Celcius (CELH). Tale of the Tape!

Adding Celcius to the 2025 Beverage Watch List.. again.

When we first came across Celcius we were optimistic that with a little bit of luck, (news related to consumer acceptance), it could get to $4.00 or $5.00 a share. Never in our wildest imagination did we think the share price could go to $100 – much less $264. This is why we love beverge companies. You just NEVER know what will click (or not click) with the 260 million adult consumers in the US. But when you’re right, you’re right and golden.

So we will keep looking for the net big winner. While it ain’t easy, due to vicious competition, it’s the thrill of the hunt for us. We’ll have the latest Beverage Stock Review 2025 Watch List out in the next week with some very interesting names, that are well below Wall Street’s radar. Much like Celcius was under the radar, when we found it and when there was zero analyst coverage.

As for sales and revenues for Celcius, we were optimistic, thinking again – that with a little bit of luck, it could grow from a tiny base of $17 million to as much as $50 million in a few years. And indeed it did, hitting $50 million, three years after we added it to the Watch List, in 2015.

Never in our wildest imagination though did we think sales could DOUBLE to $130 million two years after that, and then DOUBLE again to $300 million the following year, and DOUBLE to $600 million the year after that, and DOUBLE yet again to $1.3 billion the year after that in 2023! Wait, what?

We’ve never seen anything like that before, and may never again. The primary reason is once start-ups provide “consumers-like-the-beverage” news (typically defined as over $50 million in sales), they often get acquired by a Coke (KO), Nestle (NSRGY) or Dr Pepper (KDP) who are also on a constant hunt. Looking to strike, before an acquisition target is acquired by a competitor.

In fact the game plan for many start-ups is not to grow organically (or profitably) year over year. They simply want to get to the $50 million “tipping point,” and then get acquired. It’s the beverage giants with massive shelf space, who can take the $50 million in revenues and grow it into $1 billion. They know that, and so they often acquire these small start-ups and pay premium prices, without regards to the start-up being profitable or not. Over five times sales, is not unusual. In fact it seems that profitability, doesn’t even enter into the equation to the billion dollar giants.

(Moral of the story: stay away of beverage start-ups if you expect reported earnings to drive a start-ups share price. Cause it ain’t gonna happen.)

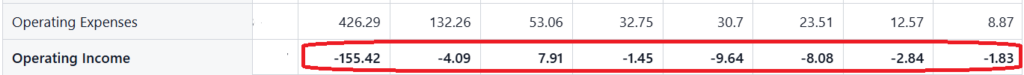

Losses (in millions) from 2015 – 2023

Unfortunately investors don’t get to witness first hand, this kind of start-up growth – because the acquired companies will be under the umbrella of a billion dollar international conglomerate. And they typically don’t break out how the individual brands they acquired, perform post acquisition. Keurig Dr Pepper (KDP) for example with $15 billion in revenues, owns 36 brands. Not many people know how many cases of Canada Dry or Core Nutrition they sold. Core was bleeding red for years before Dr Pepper acquired it for $525 million.

Not many people will know the future sales numbers for Poppi, now that it was acquired by Pepsi (PEP) which has sales of $91 billion. Wait, what?

It’s a very risky game (somewhat obviously) for any small company to grow at a break-neck fast (and at all cost), meaning without regard to profits or profit margins. These start-up companies require investor support, either privately through VC’s or Private Equity funds. Or by being publicly traded and continually doing secondaries – with a goal of reaching “breakeven” operations (and a breather) and/or being acquired.

Note also, it’s not easy for the instant gratification crowd to hold onto a publicly traded start-up, when they report sales of $30 million and a loss of $9.6 million like Celcius did in 2018. The stock was near $2.00 at the time.

Would you have bought (or held) Celcius after seeing the more they sold, the more they lost? Honestly.

The most recent example of a money losing company getting acquired is Poppi, which started in the kitchen of the Ellsworth family, a husband and wife team, ten years ago. Last week Pepsi announced they would acquire Poppi for a Whopping $1.9 billion.

As in Bill E Yun. What the?

The acquisition included $300 million of anticipated cash tax benefits. Meaning Pepsi now gets these tax loss carry-foward benefits. Meaning Pepsi KNEW Poppi was hemmoraging cash and unprofitable.

One of the tough things on Wall Street with companies like this, is inexperienced investors in start-ups often make the mistake to focus solely on traditional fundamentals – like earnings and profit margins. So shareholder loyalty is often fleeting, with investors getting in and out in a wash, rinse and repeat manner, creating incredible volatility.

But consumers liked Poppi. And so Pepsi liked them. Simple.

Pepsi Co Buys Prebiotic Soda Brand Poppi For Nearly $2 Billion.

Another high-profile example would be Core Hydration which owned Core PH Water. It was acquired for $525 million by Dr Pepper. Filings reported they had raised $69 million prior to being acquired. So in basic terms, private investors made near 10X their money.

They also had $435 million in tax benefits, so like Poppi. So they were hemorrhaging cash.

Core Nutrition Raises $39 Million Privately (BevNet)

Core Nutrition Acquired for $525 Million

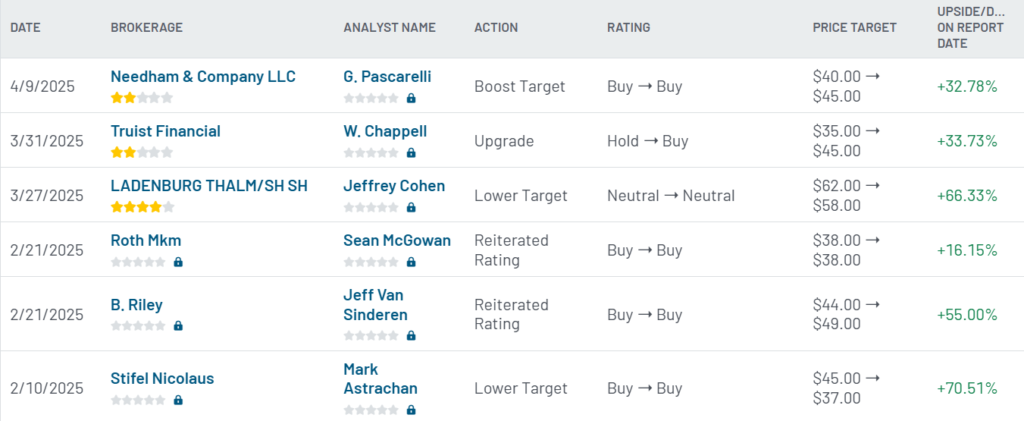

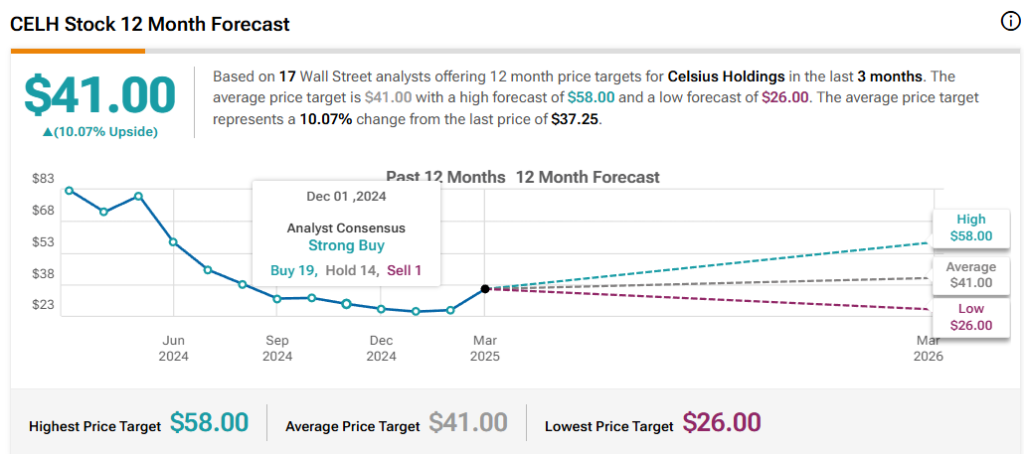

The past year has been rough sledding (see chart below) for the Celcius stock and now we feel enough is enough. While it would be impossible to repeat the 260 fold gain in the next ten years, we think expecting an above market rate of return, is a sound bet from these levels.

SHORT TERM CHART

RELATED:

Celsius Holdings Completes Acquisition of Alani Nu for $1.8 Billion.

Celsius: Floor And Renewed Growth Opportunities Are Here – Reiterate Buy. April 7th.

Celsius: Valuation Finally Seems Attractive. April 8th.

Celsius – Analysts’ Recommendations and Stock Price Forecast (2025)

Alani Nu press release contains statements by Celsius Holdings, Inc. (“Celsius”, “we”, “us”, “our” or the “Company”) that are not historical facts and are considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may address, among other things, our prospects, plans, business strategy and expected financial and operational results. You can identify these statements by the use of words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,” “will,” “would”, ”could”, ”project”, ”plan”, “potential”, ”designed”, “seek”, “target”, variations of these terms, the negatives of such terms and similar expressions. These statements are based on certain assumptions that we have made in light of our experience in the industry as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate in these circumstances. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. You should not rely on forward-looking statements because our actual results may differ materially from those indicated by forward-looking statements as a result of a number of important factors. These factors include, but are not limited to: changes to our commercial agreements with PepsiCo, Inc.; management’s plans and objectives for international expansion and global operations; general economic and business conditions; our business strategy for expanding our presence in our industry; our expectations of revenue; operating costs and profitability; our expectations regarding our strategy and investments; our ability to successfully integrate business that we have acquired, including Alani Nu, or that we may acquire; our ability to achieve the benefits that we expect to realize as a result of our acquisitions, including Alani Nu; the potential negative impact on our financial condition and results of operations if we fail to achieve the benefits that we expect to realize as a result of our business acquisitions, including Alani Nu; liabilities of the businesses that we acquire that are not known to us; our expectations regarding our business, including market opportunity, consumer demand and our competitive advantage; anticipated trends in our financial condition and results of operation; the impact of competition and technology change; existing and future regulations affecting our business; the Company’s ability to comply with the rules and regulations of the Securities and Exchange Commission (the “SEC”); and those other risks and uncertainties discussed in the reports we have filed with the SEC, such as our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Forward-looking statements speak only as of the date the statements were made. We do not undertake any obligation to update forward-looking information, except to the extent required by applicable law. Not a client.

Alkaline Water is a client, of course, full disclosure and disclaimer in upcoming report. May the force be with us.