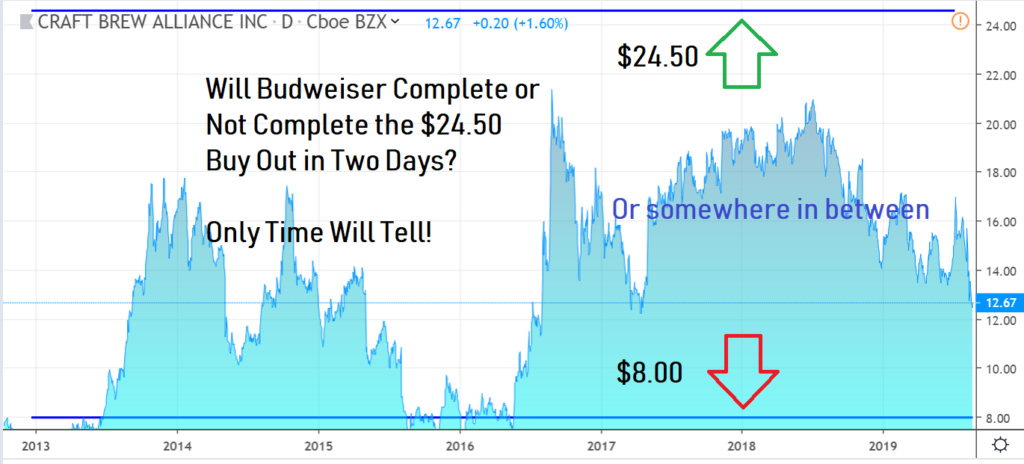

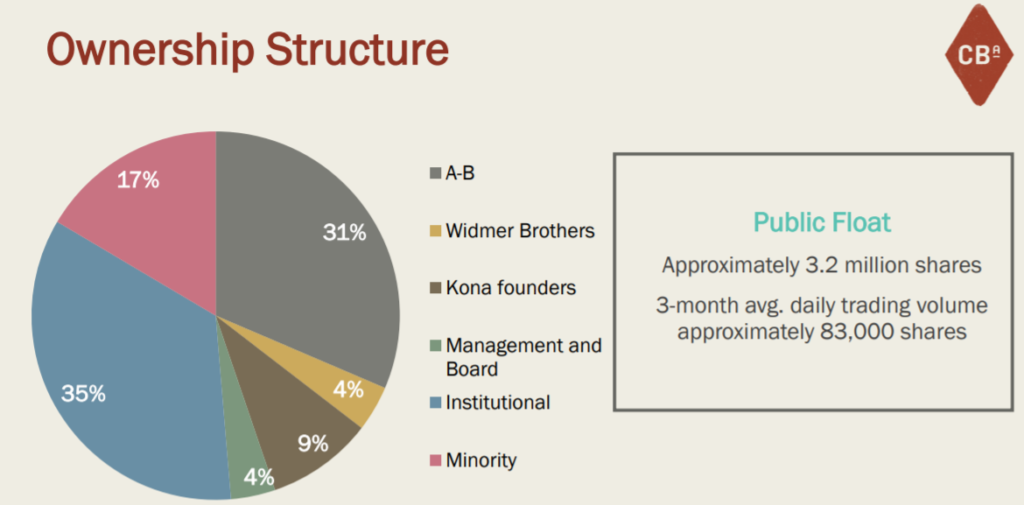

Anheuser-Busch InBev (BUD has until August 24th to acquire Craft Bew Alliance at $24.50 per share (or extend or walk, really).

This is an offer that is on the table folks – not a rumored one. Whether they actually go through with it, is another question.

Using options is always a highly risky proposition. What we are highlighting below is your basic all or nothing type of trade. You’ll wake up Monday with zero (as in nothing, nada, complete loss) or one hell of a payday that could lead to jumping on a plane and spending your winnings (if any) in Spain. We recommend spending time at Festival La Tomatina in the town of Buñol. Live a little!

We’d go, but we’ve been traveling for two months and it’s time to get back to work!

8K on terms 8/23/16 without amendments, if any.

LIVE CHART, CHECK BACK IN TWO DAYS.

#1. No Balls No Baskets, Options Trade Idea.

#2. Some Balls, Maybe a Basket – Worth a Shot, Options Trade Idea.

#3. Small Balls, Maybe a Basket – Stock/Option Combo Idea.

Fun Opportunities (sometimes called Risk Arbitrage) of this magnitude rarely come around. So pay attention.

This isn’t advice, mind you. We’re also not predicting the outcome – meaning Craft Brew gets acquired or the beer can gets kicked, or a last-minute competing offer shows up out of the blue.

(See third party analytics links below, mostly bullish)

We will say that in our opinion that Craft Brewing (BREW) is worth owning at these price levels (for the long-term). So that means an equity-only speculator has two choices. A) Buy now, get lucky and tender your shares for $24.50 on August 24th or B) Sit on the sidelines and hope there is no deal, then if the stock trades down on the ‘no merger’ news as short-term ‘flippers’ sell, then buy at the point of maximum selling (your call).

But let’s move beyond that and walk up to the gambling table and consider making bets trading options.

BIG PICTURE the near term upside is $24.50 and for the purposes of options trading, the downside is 100%.

Kona Brewing Co. ‘San Diego :30 Broadcast’ from Silvermine Productions on Vimeo.

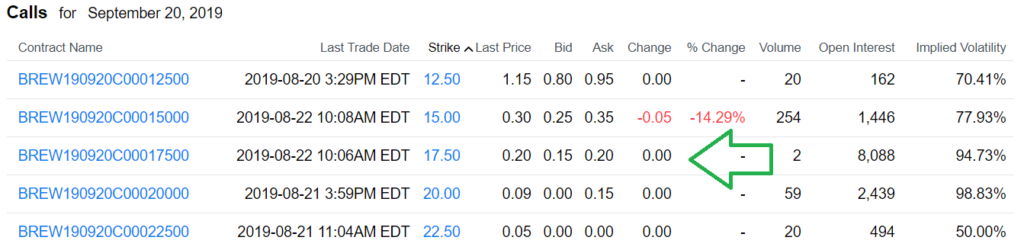

#1. No Balls No Baskets, Options Trade Idea.

In a simplest of analytical exercises – this is the dollar upside/downside. This assumes the deal goes through without a hitch, change in terms or whatever can go wrong, goes wrong.

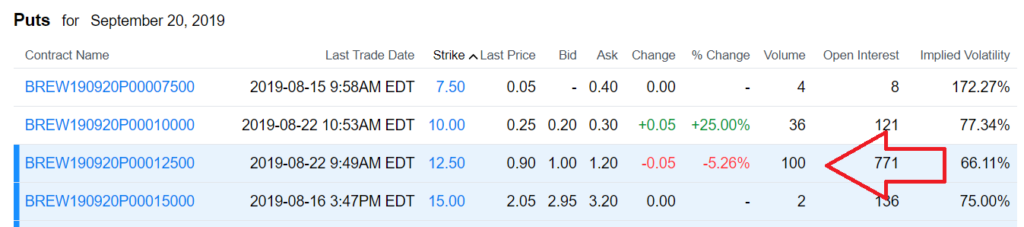

Let’s say a speculator bought the BREW options which expire in September that lets them buy BREW from now until late September for $17.50 for $0.20.

No-deal means $0 and you lost $0.20 (100%)

Deal (assuming the stock jumps to $24.50*) means the option should be worth $24.50 – $17.50 or $7.00. Hoo-ha.

So the downside is $0.20 and the upside is $7.00.

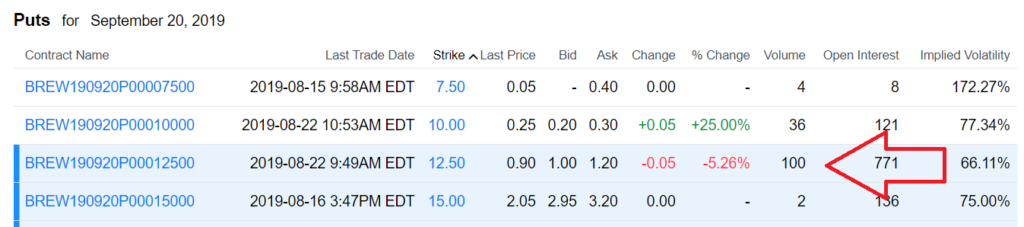

#2. Some Balls, Maybe a Basket – Worth a Shot, Options Trade Idea.

This equally simple exercise assumes that in a couple of days, BREW will either be trading greatly above or below $12.50. In this instance, you buy the above call AND buy a put in equal dollar amounts just to keep is simple.

Talk to an experienced options broker to fine tune your strategy.

This time we’re buying the September $12.50 puts for $1.00.

No-deal and assuming the stock drops to $8.00 (see above chart). This means the option should be worth $12.50 – $8.00 or $4.00. No Deal also means you lose $1 on the calls (5 calls). So $4.00 – $1 you paid for the put, minus $1 you paid for calls – means you still made out alright.*

Deal, same as above $7.00’s from outright call buy, less the $1 you paid for put option.

Now there are too many things that can go wrong with idea #2 to list (mainly the stock goes up $1.00 after no merger news) – which means you lost on both trades! But if you’re the type that is anal or just likes a complicated life – start crunching your spreads/straddles.

#3. Small Balls, Maybe a Basket – Stock/Option Combo Idea.

Way back in our days with the venerable and seemingly invincible (at the time) Drexel Burnham Lambert in the 80’s, we played risk-arbitrage and this was one of our favorite fun trade strategies – to entertain and often make money for our clients. It worked great until it stopped working great.

The strategy here is to buy a put above the current share price which guarantees we sell higher, less the cost of the put and still keeps us ‘in the game’ while actually limiting our loss to a specific amount. You can do that on Wall Street, you know! AND since we knew our exact exposure, we did the combo on margin back then.

Simple exercise #3.

Buy 10,000 shares of BREW on margin for $120,000. $60,000 on margin.

Buy 100 $12.50 puts for $1.00, meaning you can sell the 100,000 shares you bought for $12.50 for $12.50. The cost for insurance is $10,000. You’d lose that $10,000 on the $70,000 investment if the deal goes through.

No Deal. If the stock falls to $8.00 you exercise your put and get out of the stock at $12.50 you’re EVEN. You lose the $1.00 per share you paid for the put. There are many versions of what you can do on no-deal news including selling the puts for a profit and keeping the stock, but you can figure that out on your own.

Deal. Again assuming it jumps right to $24.50. You sell the 10,000 shares for $24.50 ($245,000), pay your broker the $60,000 you borrowed and write off the $10,000 you paid for insurance and you win $175,000 on a $70,000 investment.

We’re not too good at math, but how often do you come across a risk/reward like that?

Not bad...

ANALYSIS PARALYSIS:

3 Reasons Anheuser-Busch Will Probably Try to Buy Craft Brew Alliance (BREW).

Craft Brew Alliance (BREW) Running. Up 21% in Past Week!

A Reassessment Of the Street’s Conclusion That the Deal Won’t Close.

Who Will Acquire Craft Brew Alliance, $15 (BREW)? If Anyone, by the 8/23/19 $24.50 Deadline.

MUST READ

Craft Brew Alliance, Inc. (BREW) CEO Andy Thomas on Q2 2019 Results

RISK ARBITRAGE 101

So will we wake up Monday morning to see the $0.20 Sep $17.50 calls trading at over $5.00 and be saying A) “Oh well, shoulda-would-coulda” Or B) “Drinks on us, at the Tiki bar all week!”

8/22/2019