The more one surveys the financial and economic landscape, the more one appreciates just how unique things are right now.

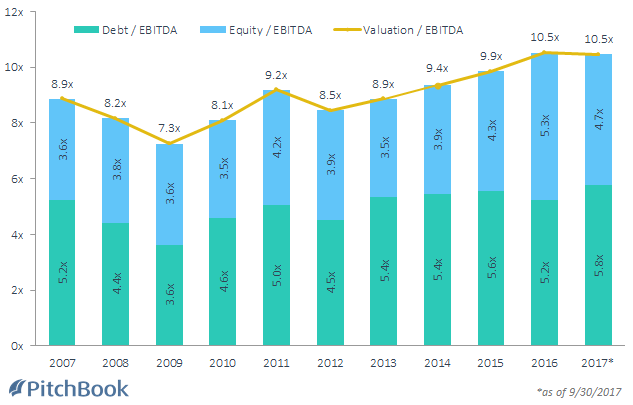

A growing reservoir of cash is surrounding private market participants, be it GPs sitting on more and more dry powder or entrepreneurs, existing investors and equity holders enjoying more attractive deal terms— amid a steady decline in liquidation participation in VC rounds, for instance—and higher deal multiples (shown below). LPs, as I’ve discussed previously, are contributing to this dynamic by ” reaching for yield” as asset return assumptions diminish.

While there are many idiosyncratic factors in play in each of these areas, common threads emerge as one looks across asset classes and risk categories. Mainly, an abundance of cheap capital enabled by low interest rates and confident investors.

US M&A transaction multiples (including buyouts)

In the public markets, cyclically adjusted price-to-earnings multiples have only been exceeded during the terminal phase of the dot-com and pre-Great Depression bubbles. Sentiment and fund positioning are ebullient. Volatility is nonexistent, with the S&P 500 enjoying one of the quietest, most consistent uptrends in history: BofA Merrill Lynch notes that the S&P 500’s maximum year-to-date selloff is less than 2%, on track for the smallest-ever decline since the data started in 1928.

Fixed-income markets are tearing it up as well, driving down the cost of capital across the economy.

Corporate bond yields are holding near post-QE3 lows near 3.5%—well off the financial crisis high of 10%+. Credit default swaps are extremely cheap, suggesting investors are assigning minimum risk to the threat of nonpayment. Corporate bond spreads over US Treasuries recently fell to the lowest level seen since 2007.

According to the PitchBook Platform, private debt fundraising is set to hit a post-recession high, at roughly $72 billion for the year-to-date, already exceeding 2016’s full-year total. High-yield bond covenant quality suffered its largest-ever decline in August to match cycle lows as the share of “cov-lites,” which offer less default protection to investors, comprise a record share of overall outstanding US leveraged loans.

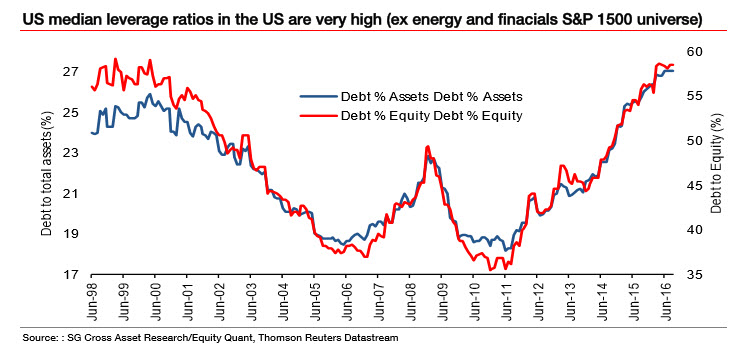

All despite the fact, as shown below, median US debt-to-total asset ratios have exceeded the peaks of the last two economic cycles, according to Societe Generale. It’s hard to imagine the situation being more perfect. Or cash, broadly defined, any cheaper. Or the risks—as measured by higher leverage not being reflected in spreads, CDS prices, or yields—more ignored.

Maybe perfect isn’t the right word. Pollyannaish, maybe?

As a result, cash reserves are pooling in the hands of VC and PE firms as supply (originating with trillions in cheap money easing from global central banks) exceeds demand (amid relatively disappointing measures of new business formation). Capital overhang figures are staggering, as outlined in PitchBook’s 2017 PE & VC Fundraising report:

- Dry powder levels in North American and European PE funds reached new heights of $738.7 billion as of year-end 2016, surpassing the capital overhang levels at the end of the last fundraising cycle in 2007 and 2008.

- VC overhang is still at a near-record total of $119.8 billion, more than $4 billion higher than any year in the past decade.

Amid the saturation of capital, the very way private markets operate is beginning to change. More unicorns are appearing as valuations swell, and companies like Uber delay IPOs and instead push deeper and deeper into late-stage funding rounds. Exit times are extending. And on the opposite end, VCs are pushing earlier into the startup lifecycle, with buzz surrounding the raising of new pre-seed funds that aim to step in where family, friends and individual angels traditionally bootstrap embryonic enterprises.

Ultimately, all credit cycles are expected to die of the same ailment: Monetary policy tightening necessitated by higher inflation and made painful by the evisceration of animal spirits and irrational exuberance. But clearly, with the US Federal Reserve only now starting the process of normalizing its bloated $4.4 trillion balance sheet eight years after “QE1” was launched and inflation relatively tame, we’re not there yet.