Molson Coors (TAP) unveils direct-to-consumer shopping platform (FoodDive.com)

Dive Brief:

- Molson Coors ($TAP) launched an e-commerce platform for its Blue Moon brand this month after unveiling a similar concept for Coors Light in February, according to Digiday Magazine.

- The company said it plans to integrate shopping capabilities into its social media ads and through display media. Because of restrictions for manufacturers to ship alcohol directly to consumers, Molson Coors is partnering with third-party companies Drizly and Minibar Delivery to fulfill the checkout, delivery and pickup components of its online orders.

- Online beer purchases also have another benefit for the beer giant: consumer data. “A direct-to-consumer website allows us far deeper insights around clickstream data, consumer behavior, how they operate and where they live,” Trey Harshfield, Molson Coors’ global director of e-commerce, told Digiday.

SPONSORED BY HERELearn how to instantly dispatch drivers with the shortest ETA

Discover how you can apply real-time, predictive and historical traffic data and leverage location intelligence to improve and optimize your on-demand delivery service.Download eBook

Dive Insight:

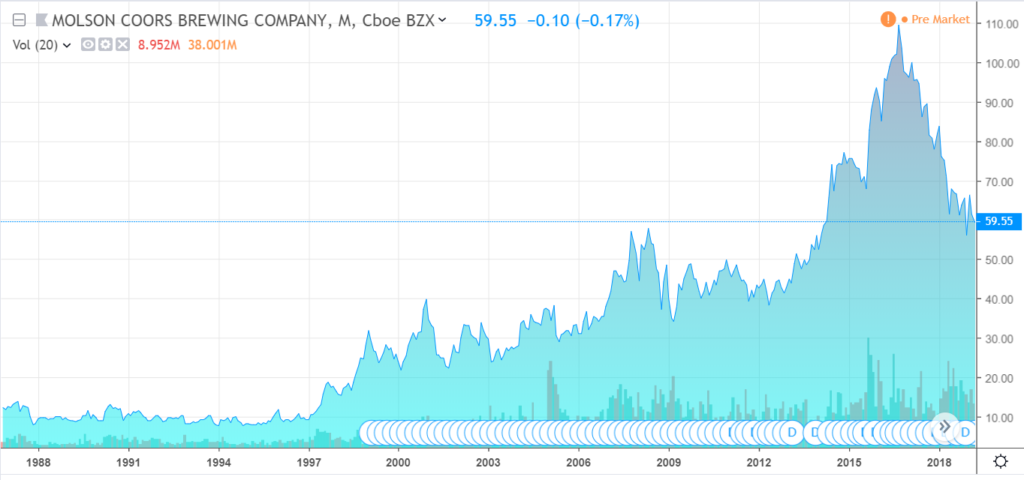

After several years of decreasing volumes and dropping sales for the beer industry as a whole, Molson Coors has decided to take a new approach and meet consumers where more of them are spending their time: online.

Just this week, overall online shopping sales were higher than brick-and-mortar for the first time in U.S. history. And that growth trickles down to every industry. Rabobank analysts reported U.S. online alcohol sales hit$1.7 billion in 2017. While that’s a relatively small total dollar value, growth in online channels is outpacing brick-and-mortar retailers.

First started in 2013, on-demand alcohol delivery apps processed more than $100 million in sales in 2017. Not only are the niche alcohol delivery apps experiencing explosive growth, but Rabobank research analysts noted that in 2017, Amazon’s alcohol sales skyrocketed by 230% in Germany and 96% in the U.K. As a result of its overseas success, Amazon is now offering alcohol delivery in Seattle; Portland, Oregon; Cincinnati and Columbus, Ohio, as well as several other cities through its Prime Now service.

With growth potential in e-commerce, it could be a mistake if industry giants like AB InBev and Molson Coors, who have seen their U.S. sales drop in recent quarters as consumers flock to wine, spirits and Mexican and craft brews, don’t readjust their strategy to take advantage of this growing market.

Although regulations make it complicated to distribute online orders — alcohol brands may not create a direct relationship between the consumer and the brand, which has necessitated a three-tier systemwhere no one player can be involved in more than one tier — there are plenty of third-party distributors to help Molson Coors reach its consumers with a delivery.

To test the waters, the beer giant is diving in with two of its key brands: Blue Moon and Coors Light. Sales volumes in the U.S. declined 5.1% in Molson Coors’ fourth quarter, the company said in its most recent earnings report. This decrease corresponds with the industry’s broader decline, which is not showing any signs of improving any time soon.

“We anticipate further contraction of the U.S. beer industry volumes, which we plan to offset by adding resources to accelerate our portfolio premiumization and improve our industry volume share trends,” Mark Hunter, Molson Coors’ CEO, said on a conference call in February.

Molson Coors has the option to offer its beers through existing online retailers. However, by opening up another retail avenue with its own platform, the brewer hopes to encourage more sales as well as to better understand data, including when consumers are purchasing and where they live. All of this information can then be used in more traditional marketing channels to sell more beer in supermarkets and retail outlets.

Blue Moon, a popular brand the brewer produces, appeals to a different demographic of beer drinkers who prefer creative flavors and craft brews. By opening this beer up for purchase online, Molson Coors is once again hoping to glean insight into the market for those who prefer craft brews and flavored beverages — two segments of the beer market to post sales gains in 2017, according to the Beverage Information Group’s 2018 Beer Handbook.

If this shopping method resonates with consumers and generates sales and valuable data for the brewer, there is a good chance that Molson Coors will offer e-commerce options for all its brands. Since the company already plans to integrate online shopping into its social media ads and grow this strategy, it seems like it is only a matter of time before the beer giant further taps into the growing online space.