Whenever a Compay puts up big numbers and doesn’t get a corresponding move in its share price (or any reaction at all), you have to take a look. It’s investing 101.

Introducing Life On Earth (LFER) our favorite small-cap beverage incubator.

- Records $1.3 Million in 1st Quarter, Up 51% from 4th Quarter.

- Assets Increase to $3.3 Million, Up 50%.

- Shareholder Equity Turns Positive.

“Reports 51% Revenue Growth Over Previous Quarter.”

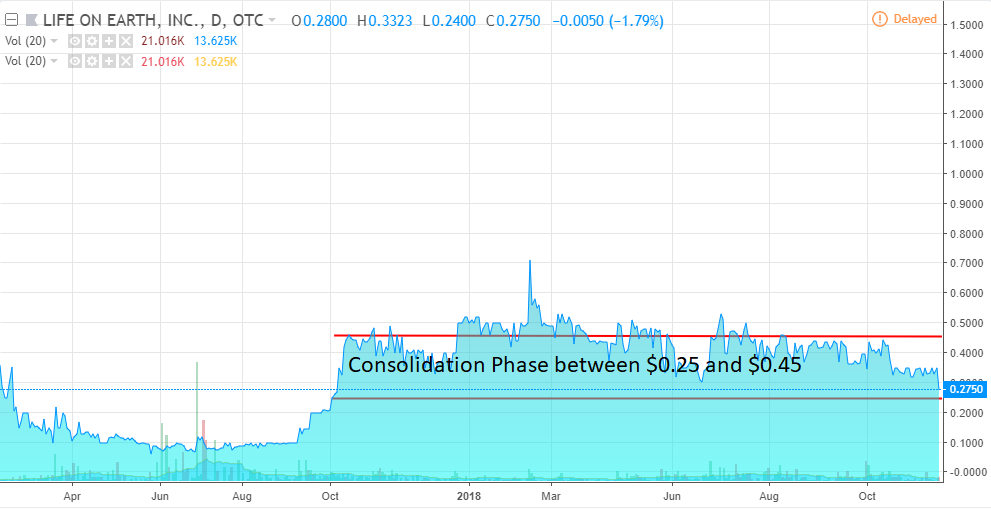

After Tripling in Price – Life on Earth Consolidates and is Poised for an Exciting 2019 as it Begins to Actively Market and Distribute Two High-Potential Brands.

Everything is going as planned under the guidance of Fernando Leonzo CEO, a highly experienced beverage industry veteran, as the recent quarter displayed when Life On Earth (OTCQB:LFER) reported record sales. On a semi-annual basis sales have steadily increased from $320,000 to $1,283,000 and $2,954,000.

After tripling in share price during the fall of 2017, $LFER has consolidated trading between $0.25 and $0.45 offering aggressive investor the opportunity to acquire shares at a market valuation under $10 million. This, in our opinion, offers a tremendous value going into 2019, ahead of brand roll-outs.

‘As planned’ refers to LFER’s strategy to acquire and grow both smaller beverage distributors and up and coming beverage brands. To date LFER has successfully acquired two distributors ES Distributors (CA) and Giant Beverage Distributors (NY) and two extremely exciting beverage brands; Victoria’s Kitchen (CA) and Just Chill (CA).

Bigger picture is LFER’s intent to continually seek out fast growing ‘under-the-radar’ brands which have brand break-out potential (over $100 million) that are still too small to be acquired by major brands which are also on the acquisition hunt. Such as Coca Cola (KO) and Keurig Dr Pepper (KDP) which just acquired Core Brand Water for $525 million. Core was a break-out brand with significant loses (most beverage start-ups initially lose money) with sales estimated near $200 million for the trailing twelve months. Core was launched in 2015, showing the potential really, of any new start-up brand. LFER has a market capitalization near only $10 million.

What excites us most about LFER is the potential to find the next Core Brand at an early stage to provide the maximum return to LFER shareholders. This would similarly benefit the shareholders of the acquired Company, as LFER primary uses stock for acquisition as it did with both Victoria’s Kitchen and Just Chill. This provides a potential win-win situation for all shareholders.

Client, see report disclaimer.