PORTLAND, Ore.–(BUSINESS WIRE)–

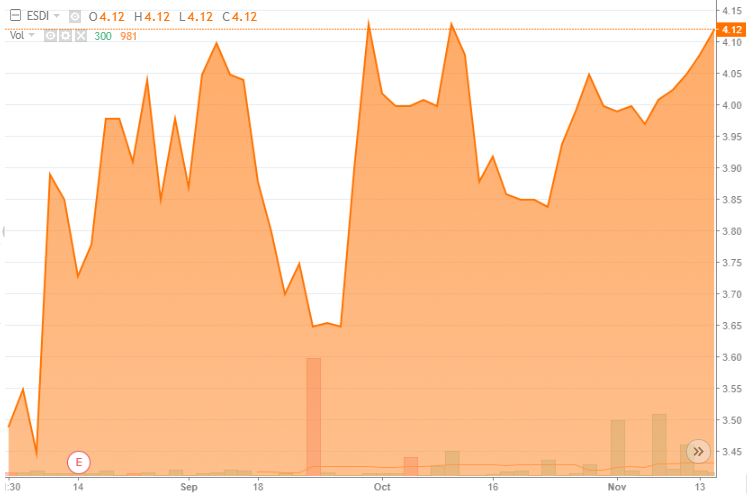

Eastside Distilling, Inc. (ESDI), a producer of award-winning craft spirits, reported third quarter 2017 financial results.

Q3 2017 Financial Highlights:

- Q3 2017 gross revenues were $895,182, an increase of 12% over the $796,222 reported in Q3 2016, resulting primarily from increased wholesale and retail sales in our Pacific Northwest core market;

- Case volume of 6,162 in Q3 (5,462 for branded products and 700 for private label), represented an increase of 55% from the previous year’s shipments of 3,974 cases (all branded products), led by record sales of our Portland Potato Vodka;

- General and administrative expenses decreased 14% from Q3 2016, as we continue to seek improved efficiencies; and

- Adjusted EBITDA improved to $(1,062,977) compared to $(1,158,393) in the year ago quarter.

YTD 2017 Financial Highlights:

- Gross revenues for the nine months ended September 30, 2017 increased 28% to $2,608,373 compared to $2,045,568 in the year ago period;

- YTD case volume of 17,027 (13,850 for branded products and 3,177 for private label), represented an increase of 62% from the previous year’s shipments of 10,496 cases (all branded products);

- YTD adjusted EBITDA improved to $(2,398,873) compared to $(2,823,753) in the year ago 9-month period.

Recent Operational Highlights:

- In October 2017, the company launched its long-awaited rebranding efforts by Sandstrom Partners of its Burnside Bourbon line of products, including its West End Blend American Whiskey, Burnside Oregon Oaked Bourbon, and Goose Hollow Reserve;

- Launched new speciality products, including “Hot Potato Vodka” in collaboration with Secret Aardvark and “Kachka Horseradish Vodka” in collaboration with Troika Spirits;

- Launched the Company’s new canning line of Ready-to-Drink (RTD) products, primarily designed for the wine and pre-mixed alcoholic drink industry;

- Several Big Bottom products won awards at the 2017 Best of the Northwest spirits competition, including taking Double Gold and Gold in the Best Whiskey category for its Barlow Trail Port Cask Finish and Delta Rye products, respectively, and taking Bronze for its Navy Strength Gin.

Management Commentary

Grover Wickersham, Executive Chairman of Eastside Distilling, commented, “The launch of our new line of Burnside Bourbon, with branding by Sandstrom Partners, is undoubtedly Eastside’s most significant development so far in 2017. With the launch taking place the first week of October, we believe it will have a significant positive effect on our fourth quarter results and into the future. In addition to the boost it will provide to Burnside, it likewise impacts our entire IP of existing and contemplated products. The remake of the Burnside brand is only the first of many Sandstrom brand innovations that are already in the pipeline for release.”

Mr. Wickersham continued, “The third quarter was driven by  217% growth of our Portland Potato Vodka, offset by limited shipments of our Bourbon products until the rebranding was completed. Our primary sales focus in 2017 has been on our core markets in the Pacific Northwest, where we have experienced strong growth. This growth has more than compensated for sales declines outside of our core markets, especially since the comparable quarter in 2016 contained an unusually large order to our East Coast distributor. During the quarter, in a difficult environment for micro-cap companies, we also completed a follow-on public offering of approximately $6.2 million, and uplisted to the Nasdaq Capital Market exchange. We at Eastside believe that we have the products, the branding and the resources to end the year on a high note and have 2018 be our best year yet.”

217% growth of our Portland Potato Vodka, offset by limited shipments of our Bourbon products until the rebranding was completed. Our primary sales focus in 2017 has been on our core markets in the Pacific Northwest, where we have experienced strong growth. This growth has more than compensated for sales declines outside of our core markets, especially since the comparable quarter in 2016 contained an unusually large order to our East Coast distributor. During the quarter, in a difficult environment for micro-cap companies, we also completed a follow-on public offering of approximately $6.2 million, and uplisted to the Nasdaq Capital Market exchange. We at Eastside believe that we have the products, the branding and the resources to end the year on a high note and have 2018 be our best year yet.”

Redneck Riviera Whiskey Co, LLC

Eastside Distilling has formed a wholly owned subsidiary, Redneck Riviera Whiskey Co, a Tennessee LLC. This subsidiary is slated to hold intellectual property associated with a proposed line of Redneck Riviera branded spirits. Both Eastside Distilling and John Rich, the licensor of the brand, will share equity in the brand itself and benefit from the increased value of the brand, if any, through the sale of licensed product. Further details about this agreement, including the Company’s strategic plans, will be announced in due course.

Financial Results

For the quarter ended September 30, 2017, Eastside Distilling reported record gross sales of $895,182, an increase of 12% compared to the year ago third quarter of $796,222. Sales growth was driven by increased wholesale sales traction within the Pacific Northwest, especially with our Vodka product as we strategically invested in programs to promote the Vodka product while waiting for our new Burnside Bourbon branding launch (which will occur in the upcoming fourth quarter), the acquisitions of MotherLode and Big Bottom Distilling, and the expansion of our private label business, as well as the addition of three retail locations.

Total shipments increased to 6,162 cases during the third quarter of 2017 from 3,974 cases in the year ago period, an increase of 55%.

Gross profit margins (as a percent of Net Sales) were 38% during the third quarter of 2017, compared to 33% in the third quarter of the previous year. Gross margins during the period improved primarily due to a combination of product mix and lower introductory pricing on a large East Coast order in the third quarter of 2016.

Advertising, promotional and selling expenses increased by $244,363; however, general and administrative expenses decreased by $169,553 as the Company focused on driving sales growth, while tightening cost controls.

Adjusted EBITDA during the third quarter of 2017 was $(1,062,977), which compared to $(1,158,393) in the year ago quarter.

Net loss attributable to common shareholders was $(1,411,161), or $(0.34) per basic and diluted share for the third quarter of 2017, compared to $(1,456,049), or $(0.92) per basic and diluted share in the year ago period.

The company ended the third quarter with $4.2 million in cash compared to $1.3 million at the beginning of the quarter as the company raised $6.2 million in gross proceeds from a follow-on public offering during August 2017.

Conference Call

The Company will hold a conference call today, Tuesday, November 14, 2017, at 4:30 p.m. Eastern time to discuss these results.

Date: Tuesday, November 14, 2017

Time: 4:30 p.m. Eastern time (1:30 p.m. Pacific time)

Toll-free dial-in number: (844) 889-4332

International dial-in number: (412) 717-9595

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Lytham Partners at (602) 889-9700.

A webcast replay will be available in the Investor Relations section of the Company’s website at http://www.eastsidedistilling.com/conference-calls or https://www.webcaster4.com/Webcast/Page/1518/23450

A telephone replay of the call will be available for three days:

Toll-free replay number: (877) 344-7529

International replay number: (412) 317-0088

Replay ID: 10114281

About Eastside Distilling

Eastside Distilling, Inc. (ESDI) has been producing high-quality, award-winning craft spirits in Portland, Oregon since 2008. The company is distinguished by its highly decorated product lineup that includes Burnside Bourbon, West End American Whiskey, Goose Hollow Reserve, Below Deck Rums, Portland Potato Vodka, Hue-Hue Coffee Rum and a distinctive line of fruit infused spirits. Eastside Distilling is majority owner of Big Bottom Distilling (makers of The Ninety One Gin, Navy Strength Gin and Delta Rye whiskey) and the Redneck Riviera Whiskey Co. All Eastside and Big Bottom spirits are crafted from natural ingredients for quality and taste. Eastside’s MotherLode Bottling subsidiary is one of the Northwest’s leading independent spirit bottlers and ready-to-drink canners. For more information visit: www.eastsidedistilling.com or follow the company on Twitter and Facebook.

Important Cautions Regarding Forward-Looking Statements

Certain matters discussed in this press release may be forward-looking statements. Such matters involve risks and uncertainties that may cause actual results to differ materially, including the following: changes in economic conditions; general competitive factors; the Company’s ability to continue as a going concern; acceptance of the Company’s products in the market; the Company’s success in obtaining new customers; the Company’s ability to obtain additional capital, the Company’s success in product development; the Company’s ability to execute its business model and strategic plans; the Company’s success in integrating acquired entities and assets, and all the risks and related information described from time to time in the Company’s filings with the Securities and Exchange Commission, including the financial statements and related information contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016 filed with the Securities and Exchange Commission on March 31, 2017. Examples of forward-looking statements in this release may include statements related to our strategic focus, product verticals, anticipated revenue and profitability. Further, such forward-looking statements in this press release include but are not limited to: that the Company’s growth will continue on its current trajectory; the stage is set for significant growth and improved bottom line performance ahead and beyond; that the second half is traditionally our busiest of the year, when the Company typically generates close to 70% of its annual business. The Company assumes no obligation to update the cautionary information in this release.

Use of Non-GAAP Measures

Eastside Distilling’s management evaluates and makes operating decisions using various financial metrics. In addition to the Company’s GAAP results, management also considers the non-GAAP measure of adjusted EBITDA. Management believes this non-GAAP measure provides useful information about the Company’s operating results.

The Company defines adjusted EBITDA as earnings before interest, taxes, depreciation and amortization, stock based compensation and gain on spin-off. The table below provides a reconciliation of this non-GAAP financial measure with the most directly comparable GAAP financial measure.

Third Quarter 2017 Financial Summary Tables

The following financial information should be read in conjunction with the audited financial statements and accompanying notes filed by the Company with the Securities and Exchange Commission on November 14, 2017 on Form 10-Q for the period ended September 30, 2017, and which can be viewed at www.sec.gov and in the investor relations section of the company’s website at www.eastsidedistilling.com.

Full Release Here.