Summary

- WTER is a young company and leader in the Specialized Beverage industry.

- The company boasts a remarkable track record of growth, and there is no slowdown in sight.

- WTER is firing on all cylinders, as it continues to expand into more stores across the country.

- This is a speculative company. Be aware.

- The company could be acquired due to its growth and position to strive in hemp-infused beverage market.

Introduction

Alkaline water. Infused alkaline water. Who knew? Who knew there were so many supposed benefits to drinking this certain type of water. Proponents claim many benefits associated with drinking alkaline water such as helping to fight cancer, prevent development of diabetes, boost immune system, etc. On the contrary, opponents claim there is little research to back up those claims. In all honesty, I could not care less if there are health aspects to consuming the beverage right now. I don’t care if alkaline water makes pigs fly or cures cancer, or is just a marketing plow by the industry, if I can profit off it, it is on the table for analysis.

Background

Based in Scottsdale, Arizona, The Alkaline Water Company (WTER) is the parent company behind the increasingly popular alkaline water brand Alkaline88. The company came to be on Feb. 20, 2013, when The Alkaline Water Company Inc. entered into a non-binding letter of intent with Alkaline88 to acquire all outstanding and issued securities of Alkaline88. Then on March 3, 2018, Alkaline Water Corp. was merged into Alkaline88, LLC with Alkaline88, LLC being the surviving entity as well as the sole wholly-owned subsidiary of The Alkaline Water Company Inc.

Alkaline88 is currently in the expansion phase of its growth. It has entered into co-packing agreements with six different bottling companies in Virginia, Georgia, California, Texas, and Arizona to act as co-packers for the company’s product. The company cites that its current capacity at all plants exceeds $7,000,000 per month wholesale. The product first launched in SoCal and Arizona in 2013.

When corporations such as Coca-Cola (KO), PepsiCo. (PEP), and Keurig Dr. Pepper (KDP) are looking at companies to acquire, there are several criteria that they look for, especially at this stage of their companies. They would want to acquire companies with strong brands that produce products and seen as pioneers in industries expected to grow significantly over the long-term. Furthermore, those corporations desire strong financials and the ability to create synergies with their other owned brands, as the last thing a company wants is to purchase a company then plow tons of capital into that business in an effort to resolve problems.

Having said that, I can visualize The Alkaline Water Company as a potential takeover target as they have performed very well with their main product Alkaline88, which benefits from strong consumer trends as people start to drink more alkaline water, deviating from high sugar carbonated beverages. Additionally, WTER’s expected inclusion and dominance of the U.S. CBD-infused beverage industry is a noteworthy tailwind. The addition of WTER into one of the beverage giants portfolios might not be as far-fetched. WTER seems to fit the mold of a company perfect if acquired by one of the “big dawgs”. We will conduct a thorough examination of The Alkaline Water Company to justify what might make this particular company very appealing to the behemoths.

RELATED: Consumers Snapping Up Alkaine88® Water at Record Pace.

Financials

This is my favorite aspect of writing pieces and investing in general… the financials. Together we will dissect The Alkaline Water Company’s financial statements to better understand the inner workings of the company and determine the financial well-being. Additionally, we aspire to analyze the strength of the operations in an effort to gauge a level of comfort for future success.

Income Statement

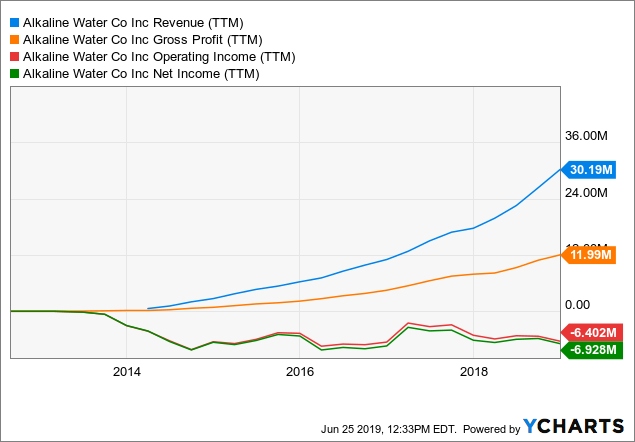

As one can see, WTER has experienced explosive top-line growth that has trickled down to the company’s gross profit, which has also grown at a noticeable clip. This undoubtedly strong top-line performance has been underpinned by strong demand for products (as you will later see), and additional or expanded partnerships. I will touch more on the top-line in a second.

What becomes very fascinating about the company and its story lies is its operating figures. WTER has yet to consistently report positive operating income. Albeit that is alright and expected for such a young and growing company. I will touch on those momentarily. As for net income, that is pretty self-explanatory… negative operating income and you will most likely have negative net income, which is the case here.

The pent-up demand has given the company the confidence to roll out new product offerings, such as its flavored Alkaline88 drinks. Expanded partnerships such as the one recently announced with Western Group Packaging (WGP) which allows WGP to begin packaging those new flavored drinks. Additionally, WTER continues to pad retail distribution as it recently added ShopRite and Publix that will sell their products in over 1,370 new stores on the east coast.

Keep in mind, these new developments come subsequently after The Alkaline Water Company announced record monthly sales in November of 2018 with sales of $3.1M. Then again, the company announced record monthly sales in May 2019 with sales of $3.8M. The latest figures showed that sales from Walmart (WMT) grew 29% among other impressive numbers.

When one couples that momentum in sales with the recent developments, there is good reason to be excited about the near-term and the long-term success of this company.

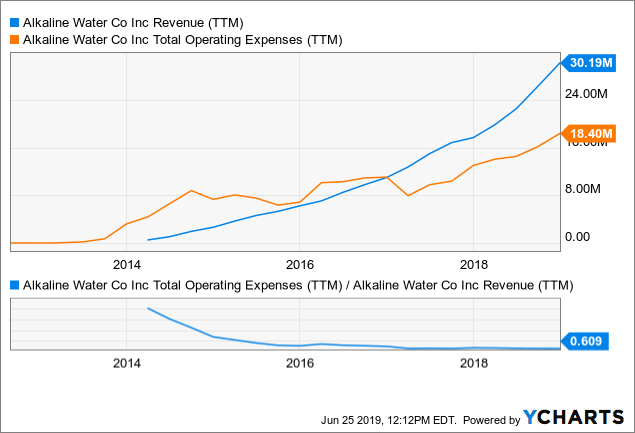

Economies of Scale are in Full Effect

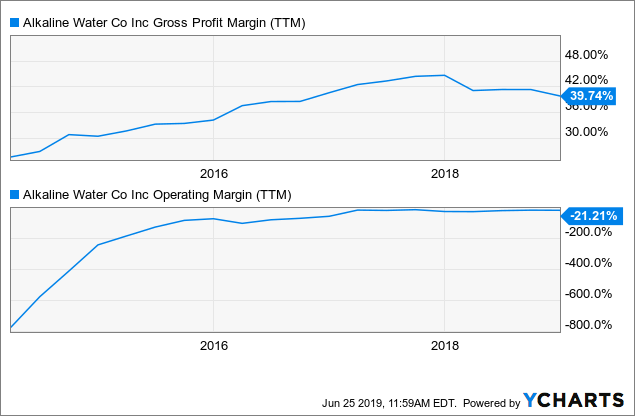

The numbers above at face value are nice, but the substance behind them are more telling. Although WTER’s top line has grown at such a great clip, it is only more recently that gross profit has really started to take off. In the graphic below, you can tell that reason behind the growth of gross profit can be attributed to margin expansion, wherein 2014 gross margin was around 24%, and of recently stood at a much improved 39%. That is a 1,500 basis point increase in a few years. This tells me that the company is able to significantly benefit from additional units sold without an equivalent jump in costs of goods sold, which is the meaning of “Economies of Scale“. The reason for this effect can be attributed to many things, but a highly prevalent explanation can be for above-average inventory turnover and its effects. This will be touched much more coming up.

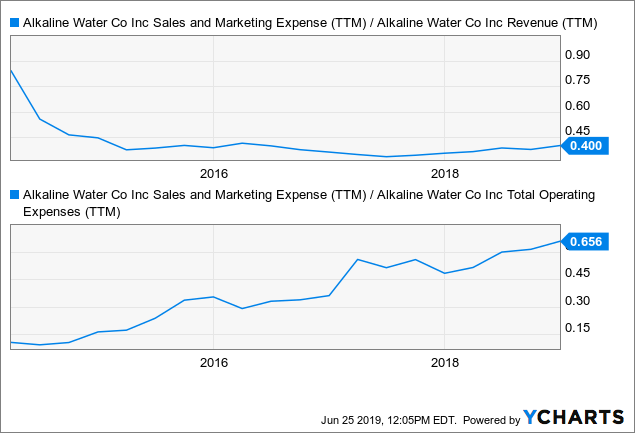

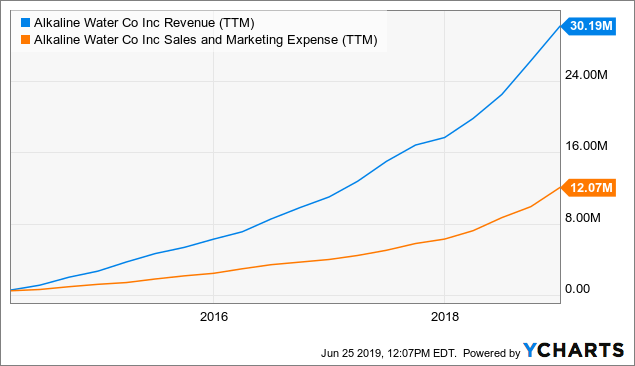

As for the operating margin, it is no secret that young companies often experience this due to proportionately higher levels of sales and marketing. Since inception, the company has done a tremendous job turning around its operating margin to a break-even point, eventually turning positive…hopefully. I am quite optimistic and here is why. The company has spent less and less on marketing in proportion to its revenue as time passed. As of the most recent filing, The Alkaline Water Company allocated 40% of its revenue on marketing, which is a very reasonable level for a company this young, and it might be considered a tad low by some. I am not complaining. This is within a realm of financial responsibility that is likely to be seen by the larger dawgs.

With sales and marketing making up ~66% of the total operating expenses, the company is much more in control over the costs and is able to scale back marketing if need be. However, at this stage, the company is seeing the effects of economies of scale from its marketing efforts.

First and foremost, the marketing the company has done has been a success. From the chart below, one can tell that the growth rate of revenue far outpaces the rate of growth of marketing. The gap between them is in fact continually getting wider. This phenomenon portrays the effects that the additional marketing is having on the company. The company is not having to put out as much advertising as it once did and is having an increasingly more positive effect. I am not insinuating the company slows down the marketing as it is wayyyyyyy too early to even think about letting off the gas.

Due to the high percentage of marketing expenses out of the total operating expenses and the high returns on such marketing campaigns, the company will be given more financial flexibility. Each additional dollar spent on marketing is having a progressively better effect on the top line, which allows the company the ability to strategically analyze and ask itself “at what point do we see diminishing returns”. This can lead to a realization of less or steady spending, or even increased spending. That is a great circumstance to have the flexibility to play with.

Having that flexibility will inherently allow the company to control its operating costs and allows it to generate positive operating profits consistently and growing rapidly. I foresee the company continuing to maintain its strong marketing returns as it is just too early to start to experience diminishing returns, especially when it launches products in even higher growth industries like the infused beverage. More on that later. Based on what I have seen, I have no second thoughts that this company will continue to see top-line growth fly like an ole SR-71 Blackbird.

Products are FLYING off the Shelves… Literally

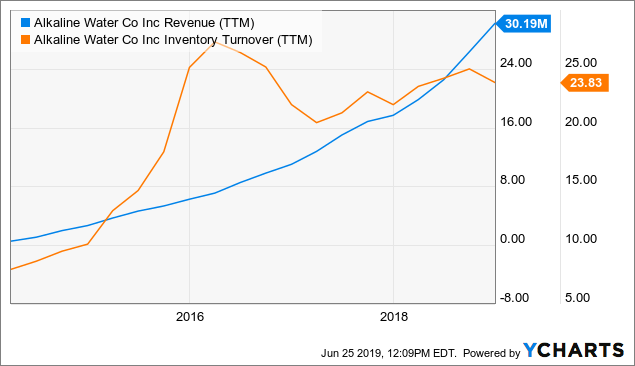

To show you just how well the company is selling its items based on the premise that when you sell an item, you must restock inventory. This is where the inventory turnover ratio comes into play. The inventory turnover ratio shows how many times a company has sold and replaced inventory during a given period. The Alkaline Water Company, as of the most recent quarter, had an inventory turnover ratio of almost 24. A high ratio can be the result of two scenarios: high sales or keeping a low inventory. According to CCD Consultants:

“A good rule of thumb is that if inventory turnover ratio multiply by gross profit margin (in percentage) is 100 percent or higher, then the average inventory is not too high.”

With that being said, when you multiply WTER’s ratio of 23.83 by its gross margin of 39.74%, you get 947%… well above the 100% ratio I might say. Thus it is fair to assume that WTER has adequate inventory levels, leaving high sales as the likely explanation. Moreover, with a figure that is much higher than the 100% threshold, it is fair to assume that the ratio is pretty high. As you can see below, the explanation for such rapid top-line growth can be attributable to the high inventory turnover it experiences.

Furthermore, there is much more the ratio can tell about the company. For instance, the inventory turnover ratio can provide investors with insight into a company’s cost structure. For example, a high ratio reduces holding costs associated with the inventory. Furthermore, there is a reduction on a per unit basis in rent for storing inventory, utilities, insurance, and theft.

Now that we understand the implications of the higher inventory turnover ratio on costs, we can look to see how that might apply to what we are seeing in The Alkaline Water Company’s costs. Based on the graphic above, I am starting to see the revenue growth is outpacing the increase in operating expenses, which tells me the inventory turnover is indeed providing at least some cost benefit. Additionally, the company employs a direct-to-warehouse distribution model that aids in controlling and minimizing last-mile logistics costs. On top of that, the water used in its products is locally-sourced which helps reduce costs. The management team feels that these measures allow the company to boast a low-cost competitive advantage. Overall, as revenue keeps growing, and there is control of variable costs, the company will be able to generate strong operating profits as operating expenses become decreasingly proportionate to revenue.

Balance Sheet

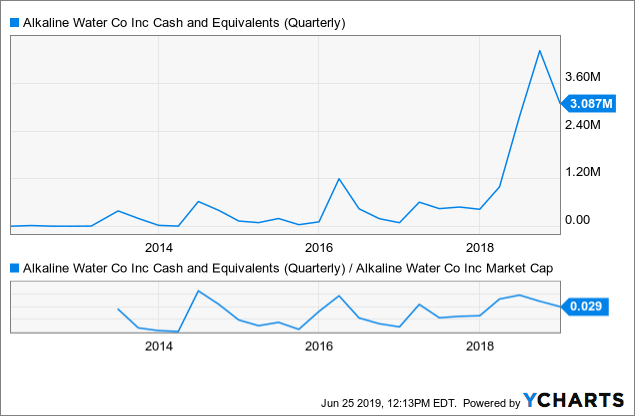

Turning to the balance sheet, for starters, the company should preferably not boast a sizeable cash hoard, for similar reasons to operating profit. You want to be putting that capital to use… i.e. marketing, promotion, etc. However, that does not give you a green light to run up your debt. Live within your means is all I am saying.

As you can see above in the lower of the two graphs, cash and cash equivalents are a growing in proportion to WTER’s market capitalization. I am not worried about it becoming too high, yet, as cash is still a very low percentage. On the flip side, cash and cash equivalents have indeed grown steadily since inception before skyrocketing this past fiscal year. The company has a history of keeping a minimal cash balance, which leads me to believe it will indeed invest the capital into products, promotion, or some sort of miniature acquisition, rather than letting it sit idle.

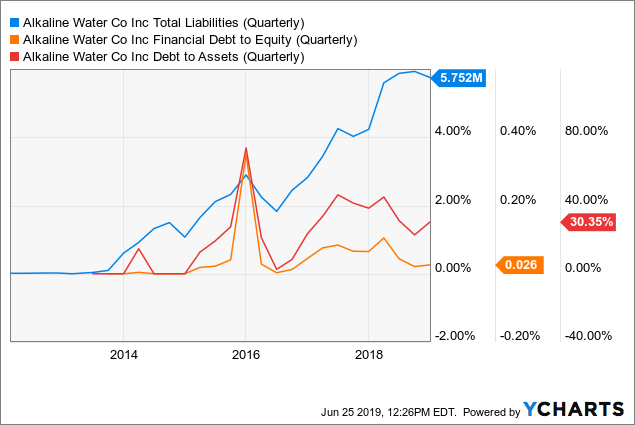

On the flipside of assets, there are liabilities. As for liabilities surrounding The Alkaline Water Company, the company has a decent amount of short-term liabilities. For starters, WTER has $2.323M in accounts payable (A/P), with another $2.749M in “Revolving Financing” that is categorized under current liabilities. I will also throw in there are another $679k in accrued expenses. This means those obligations, totaling over $5.75M, are expected to come due within the next 12 months. When I began writing this piece, WTER had $2.6M in LTD; however, it appears it has been paid off. On the asset side, with $3.087M in cash and some $2.077M in accounts receivable (A/R), the company has more than enough flexibility to handle some debt obligations if it wanted to leverage a little. On top of that, the company can issue stock, which it has.

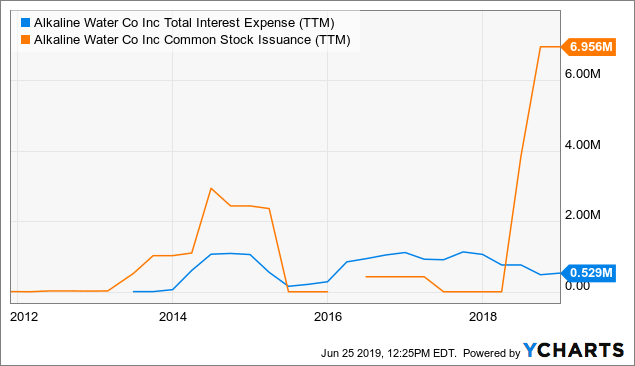

Management has been utilizing the capital markets to boost its cash balance, pay down debt, and help make interest payments. For example, through the first six months of FY’18, WTER issued 6,751,612 shares between two different issuances, one in USD and one in CDN. The proceeds from the issuances in USD came out to $6.956M. The company also paid down $83k of notes payable. I do think that management will continue to tap the capital markets to raise capital as anyone who is familiar with A/R knows you will not always receive 100% of what is owed to you, plus it doesn’t hurt to have a cash buffer just in case they need it for these looming obligations. My hunch is based on the fact that on Jan. 30, 2018, the company filed an S-3 with the SEC stating that it may sell or offer in at least one offering for an amount that may not surpass $50M.

The interesting part to note about the filing is in the company’s bylaws; it is authorized to issue a total of 300M shares with a maximum of 200M in common stock, with the balance in preferred stock. Just thought I would throw that out there. Now back to the point, I do feel that the company will sell some stock as the amount of liabilities come due, and there is no need to try to play aggressively. For a company of this size, that is a heavy load to swallow, especially when it is not generating a positive operating profit.

As for leverage, you can see the company is not highly levered in terms of debt to equity or debt to assets. However, when we take into account the amount of liabilities with how much it pays in interest and how much it can issue, it must be interesting to see how the company handles this upcoming dilemma. The lack of an operating profit is what makes this interesting. How does the company balance common stock issuance vs. taking on short-term or long-term debt? As of right now, The Alkaline Water Company has zero long-term obligations.

Having covered its balance sheet, I do feel that the company has a grip on its obligations, as evidenced by the flexibility to take on debt due to its lack of long-term debt and ability to issue some debt. At this point, I see the company only needing to issue a minimal amount of shares to cover these obligations, and it has a cushion. After this round of obligation payoffs, there should not be a noteworthy reason requiring the company to take on that level of short-term funding again. However, if it must, I firmly believe with the growth of revenue and ability to control costs, money will be able to trickle down and sooner rather than later generate some sort of operating profitability that will help ease the load. Additionally, the balance sheet flexibility will help fund growth if need be, but also allow for debt to be paid off.

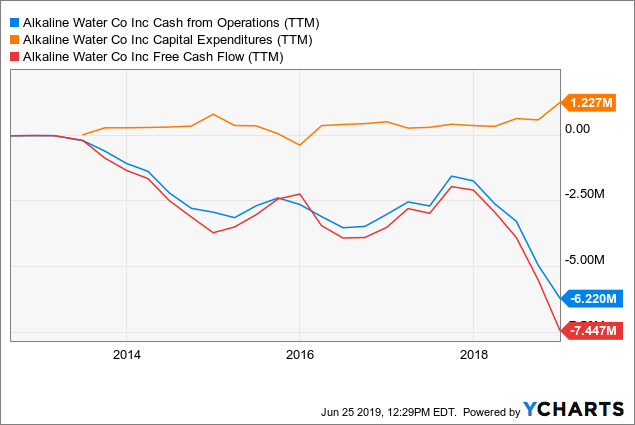

Cash Flow

There is not really much to discuss relating to WTER’s cash flow. It is currently operating cash flow (OCF) negative, which is not worrisome yet. The expected part is the negative free cash flow, as the company spends capital to expand the business. This CAPEX looks to be funded via the revolver it has (that is where the $2.323M is from) and through share issuances.

Obviously, at this point, there is nothing to be worried about with the negative OCF. It is still early in the company’s life, and generating negative net income is a major reason for the OCF results. There are bright days of positive OCF and FCF ahead, and I do see the light at the end of the tunnel. Once it reaches a certain scale and generates a certain level of profit, this company will generate fat OCF and FCF. For starters, look at how close OCF and FCF are; that tells me the conversion ratio will end up being pretty good.

It is also worth noting that the company also doesn’t have significant CAPEX due to its business model. Rather, WTER relies on co-packers and distributors, thus the expenditures associated with building out significant infrastructure or purchasing lots of property are not heavily prevalent.

Future Growth

As I have alluded to throughout this piece, The Alkaline Water Company has many growth avenues ahead of it. Most notably is the CBD-infused beverage industry, where it is expected to have a sizeable advantage over peers, as it has been and continues to find ways to build a brand and develop critical partnerships and alliances that will prove worthy. I am not going to say how much the industry is projected to be as just like Mark Cuban in Shark Tank; it doesn’t mean anything unless you get it.

For instance, the company announced it is entering a brand development agreement with ArchPoint Group. Through this agreement, its hemp-infused division, A88 Infused Beverage Division, will design the cans and bottles for the infused beverages. Furthermore, WTER just released news that it is accelerating convenience store growth as it added Crossmark Inc. as one of its national brokers.

On another note, another path of explosive growth could be derived in hemp-infused beverages. A key driver of this market was the passing of the Farm Bill in December of 2018 which legalized hemp. Not only for WTER but also for the industry, this legislation unlocks a whole new market to be profit from. However, prior to that, WTER launched a hemp-infused beverage division called the A88 Infused Beverage Division, Inc. The company outlines that the infused drinks will be in the 500ml bottles with a dosage of 10mg of CBD per bottle. Lastly, the press release cites market forecasts from a research report by the Hemp Business Journal and Greenwave Advisors for hemp-infused drinks that expect sales to grow to $2.1B in 2020 and $3B in 2021 from $202M last year.

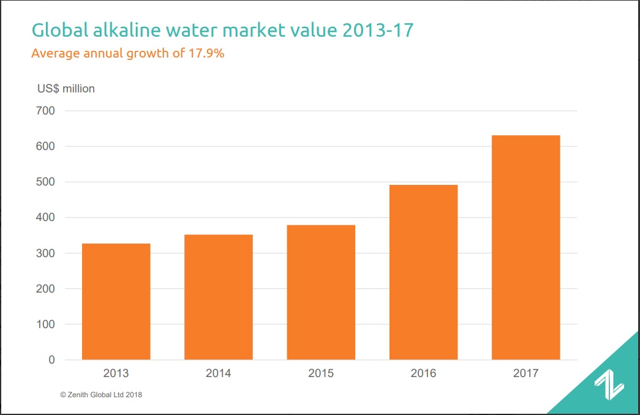

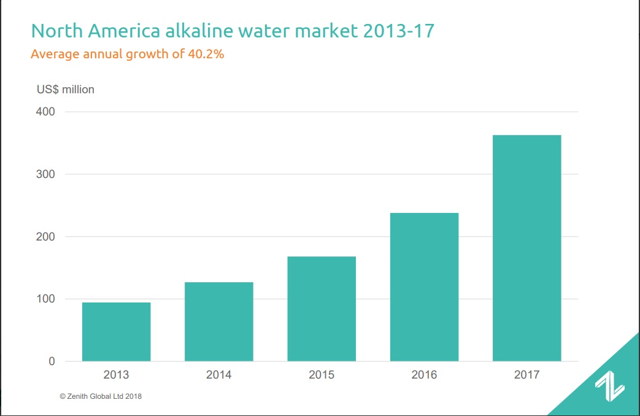

Source: Zenith Global Ltd.

Source: Zenith Global Ltd.

Last but not least is the growth in consumption of alkaline water. As you can see above, the alkaline water market has already experienced remarkable growth. However, it is the North American market that is seeing the hottest expansion. The research report put out by Zenith Global cites that the growth is “influenced partly by a move away from high sugar carbonated soft drinks, the uptake of alkaline water has been motivated by a range of health and wellness drivers, with a broadening consumer appeal.” As more people deviate from those sugary drinks from Coca-Cola and PepsiCo, the alkaline water market is set to continue its growth. When you look at recent sentiment from those top beverage companies, they too believe there is substantial growth as they have purchased or produced their own alkaline beverages. Coke launched its own version with its Smartwater brand in 2018. Pepsi launched LIFEWTR in 2017. Keurig Dr. Pepper bought Core Hydration for $525M in 2018. In all, one can fully expect that the alkaline water industry will continue to grow as consumers turn away from sugary drinks. The “big dawgs” getting involved only confirms that the industry is ripe for much expansion as they vie for a piece.

Valuation

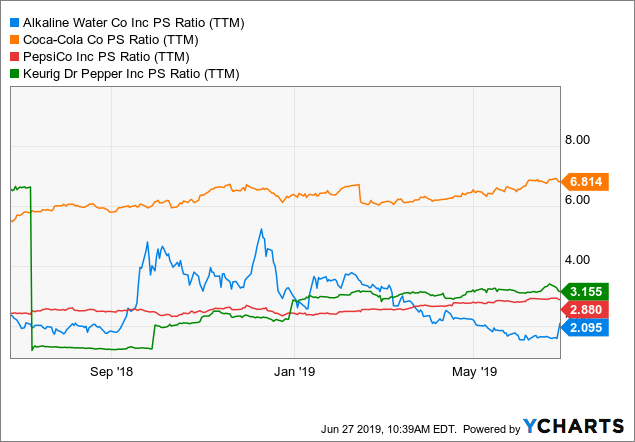

When it comes to valuation, things become a tad tricky. WTER is not profitable in either operating or net income, and it is not FCF positive, thus we must resort to sales. To value WTER, we will use the price-to-sales ratio.

For a company to be growing at its pace, and trading at 2x TTM sales, and a mere 1.7x forward sales, that is sort of low. When you take those figures and even compare the company against the main players, it is still undervalued.

The above chart tells me that the market fears that The Alkaline Water Company cannot continue its pace of growth and that the bigger players will, in a way, crush WTER (like the cockroaches they are “in Kevin O’Leary’s voice”). I do not see that to be the reality. WTER has proven to be nimble and achieve satisfying numbers. Although there is significant risk in the company due to its market capitalization and overall size, there is enough to warrant a higher multiple of around 3x. Given that and TTM sales of $1.026/share, the price should be ~$3.08, or an upside of 42.5% at the current price of $2.16.

Risks

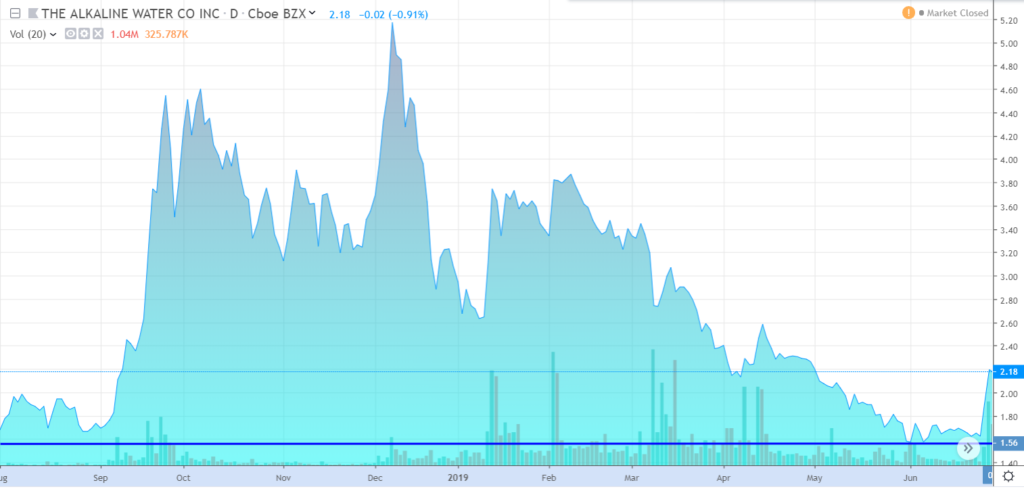

Investing in a company like WTER does come with significant risks as mentioned. For starters, the market cap of the company is only ~$70M, making it a microcap stock. Although it is a microcap, the company does trade on the Nasdaq, which does help with liquidity. Furthermore, by SEC definition, the company trades as a “penny stock”. Companies this small can be subject to volatile price swings and manipulation. When investing in companies this small, you do not just take a chance on a company from someone who wrote an article on them; conduct thorough and extensive due diligence and consult with your advisor about if this risk fits into your strategy.

Closing

In the end, The Alkaline Water Company has been able to become a leader in an emerging niche of the beverage industry. Through prudent financial and operational execution, WTER will be primed to become a multi-billionaire-dollar company. Speculative investors have a chance to get into a strong company on the ground floor. It will not always be smooth sailing; however, I feel strongly that years down the road, WTER’s share price will be much higher than it is now, which will be driven by growth of its market-leading Alkaline88 brand and expansion into hemp-infused beverages.

If you enjoyed this piece, finding this research informative and thorough, and would like more complete work, please feel free to follow me by clicking on the “Follow Me” button next to my name at the top of this article. By following me, you will get alerts and receive my research-based articles directly on your homepage. This reduces your hassle by providing you with meticulously crafted reports right at your fingertips. Please feel free to read my other research articles to grasp an understanding of my work.

BSR has no affiliation with Harrison Caplan