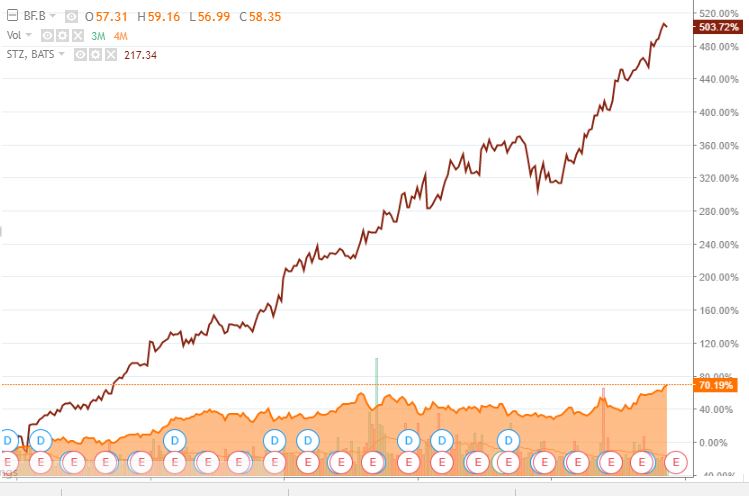

5 YEAR COMPARISON CHART STZ vs BF.B

Wine/spirits market is booming with great future prospects.

Brown-Forman Corp. shows robust gains through acquisitions and historically strong increased dividends.

Constellation Brands expansion into craft beer to compliment wine/spirits should prove major in future investment considerations.

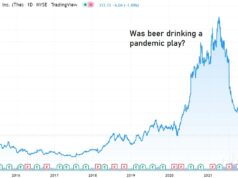

In light of a recent article I wrote on Constellation Brands (NYSE: STZ) prior to their recent earnings hit, I wanted to ask the question: what is the better value play in the wine and spirits market: Constellation Brands or Brown-Forman Corporation (NYSE:BF.B)? For my opinion on STZ, please refer to my previously published article here. Currently, I believe the better value play over the long term has to be STZ.

Past, Present, Future of Wine & Spirits

As mentioned in my previous article, in 2016 alone, supplier sales of premium spirits were up 4.5% to $25.2 billion. In good times and bad, some like to say, booze will always sell. There’s a lot of truth in that statement, specifically in the wine and spirits business.

The Case for Brown-Forman Corp.

Whether you’re familiar with Brown-Forman or not, you’ve probably run by (or enjoyed!) their products quite often. BF.B proudly produces and distributes a strong brand portfolio: Jack Daniels, Finlandia, Canadian Mist, Fetzer, Korbel, Tequila Herradura, and many more.

Brown-Forman was founded in the year 1870 and first offered pubic shares in 1933 to strongly re-enter the American alcohol market following the Depression/Prohibition years. Impressively, Brown-Forman has paid a dividend for 71 years and it has increased its dividend for 33 years in a row.

The company’s strong performances over the years can be credited to their robust portfolio and efforts to globally expand. Their first major acquisition, the Jack Daniel Distillery, came in 1956 followed by 1965’s acquisition of Korbel California Champagnes and Brandies. More recently, BF.B purchased all shares of Irish Whiskey maker, Slane Castle Irish Whiskey Limited, to continue this expansion. Just this past quarter, BF.B’s gross profit increased nearly 9% to $493 million, thanks to this progressive expansion.

BF.B’s stock price has been in a steady bull channel since July 2017 on the back of recent earnings report. June’s earnings report stated “underlying net sales increased 3%, and improved from 2% in the first half to 4% in the second half”. Underlying sales were lead by their Herradura tequila sales (+14%), El Jimador (+8%), and Jack’s Daniel family of brands (+3%). The company boasted of significant growth in both developed and emerging markets. These details have lead to an 18.01% increase in the past four months and 31.6% increase in the past eight months. Also, the company has forecasted increasing earnings estimates per share to the range of $1.85-$1.95 compared with their original guidance of $1.80-$1.90. Of note: BF.B’s earnings estimates account for a tax rate of roughly 28% and gains from foreign currency due to the reduced dollar.

In Contrast with Constellation Brands

As outlined in my previous article, STZ’s market cap has incrementally risen to $42.84 billion with a forward P/E ratio of 23.69, sitting just above the Alcoholic Beverage sector average of 23.27 and, now, consistent with the S&P 500 average of 23.28. Revenue has grown to $7.46 billion

How has STZ’s revenue grown to $7.46 billion? Major and minor acquisitions continue their strategic growth, specifically in the craft beer segment. In August, Constellation Brands acquired Funky Buddha Brewery, a craft brewery in Florida. STZ’s plan continues to be built around their previous high-end beer acquisition of Ballast Point Brewery ($1 billion purchase) by offering an assortment of craft beers.

STZ’s recently released second-quarter fiscal earnings marked its 12th straight earnings beat and 17th consecutive quarter of year-over-year improvement, a 40% increase at $2.47 per share. Net sales improved 3% lead by a 12.8% improvement in the company’s beer sales. Wine and spirits sales, however, fell 11.7%. Similar to BF.B, STZ has improved adjusted earnings guidance to a range of $8.25-$8.40 per share, compared with previous guidance range of $7.90-$8.10. The company expects continued growth in the sale of beer and an increasing market share as well as improvements in the wine market with acquisitions of Prisoner Wines and Charles Smith Wines.

Comparison

Major differences in financials between these two companies rest in market cap ($42.84B for STZ, $22.06B for BF.B), revenue ($7.46B for STZ, $3.06B for BF.B), and dividend (1.84 for STZ, 0.72 for BF.B). Noticeably, STZ is a larger company with more assets and more revenue with continued plans to expand their portfolio globally.

But, what is the better value with better growth prospects for the next 5-10 years? Judging by stock price action alone, STZ has had a much more consistent growth pattern since it went public in 1986. In the past five years, STZ’s stock price as failed to increase, per quarter, only three times. In comparison, BF.B’s stock price has fallen eight times in a quarter-to-quarter comparison. With price action still in focus, let’s make no mistake: both of these stock prices appear to be ‘over-extended’, in accordance with their 200 day moving averages. In fact, I would venture to say STZ’s price appears to be in need of a slight correction (~5%) and consolidation after another explosive earnings beat. Meanwhile, BF.B needs to have another earnings beat, like last quarter, in December and blow through their all-time highs (59.71) to remain in a bull channel.

My bottom line: both companies maintain a focus on global expansion in both developed and emerging markets which will ultimately allow for growth due to excellent bottom line numbers. In my opinion, neither STZ nor BF.B is a poor choice for the long-term investor, specifically those focused on collecting dividends. However, due to the previous market cap and revenue comparisons as well as their recent acquisitions in the craft beer world, I would hedge towards STZ being the wiser investment for the next 5-10 years.